Plasma: The Bitcoin-Secured Blockchain Revolutionizing Stablecoin Infrastructure

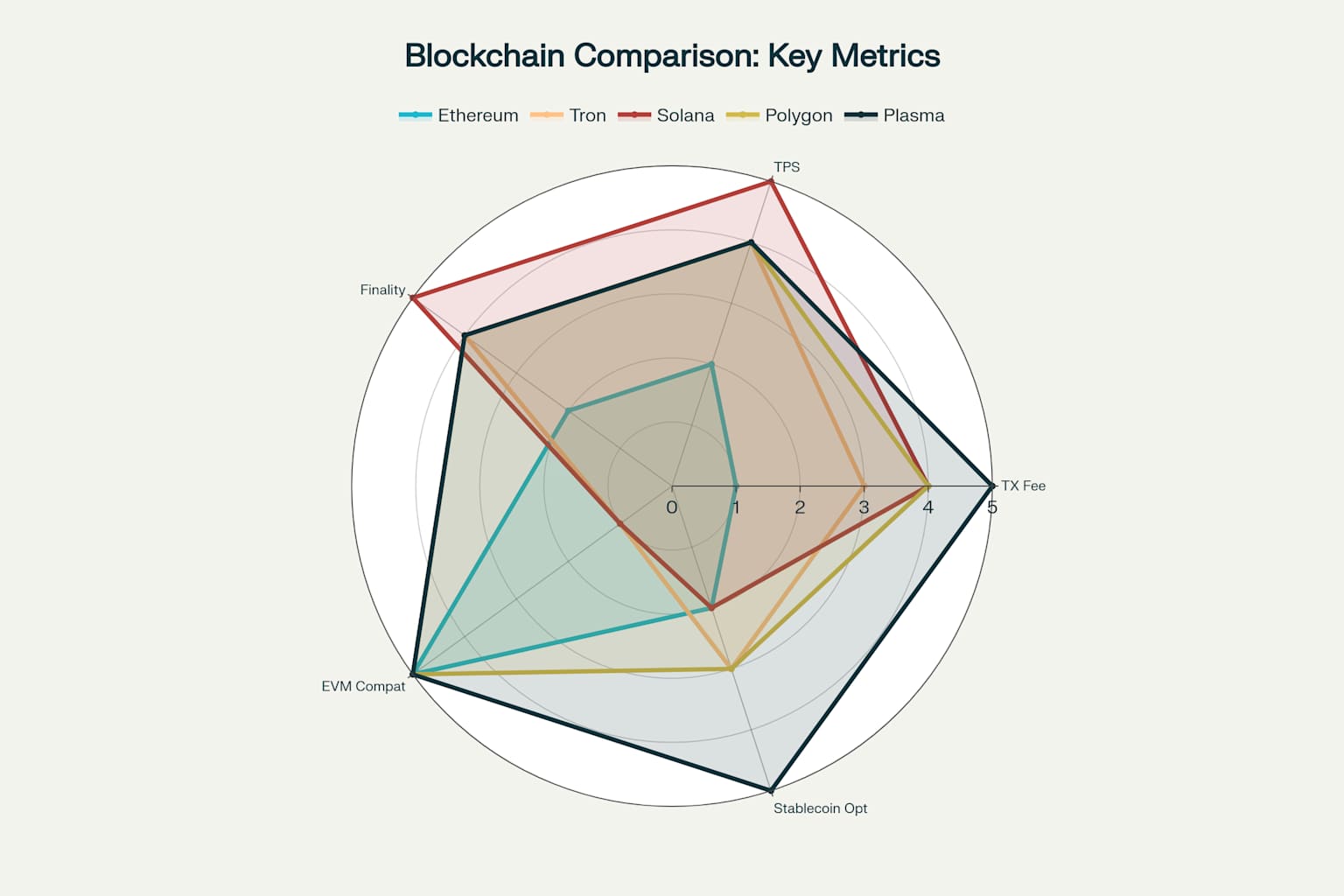

Plasma represents a paradigm shift in blockchain technology, positioning itself as the first purpose-built blockchain specifically designed for stablecoins. Unlike general-purpose blockchains that were developed before the stablecoin revolution, Plasma addresses the unique requirements of digital dollar transactions from the ground up. The platform combines Bitcoin's unparalleled security with Ethereum's versatility, creating a specialized infrastructure for the rapidly expanding stablecoin economy.

The Trillion-Dollar Stablecoin Opportunity

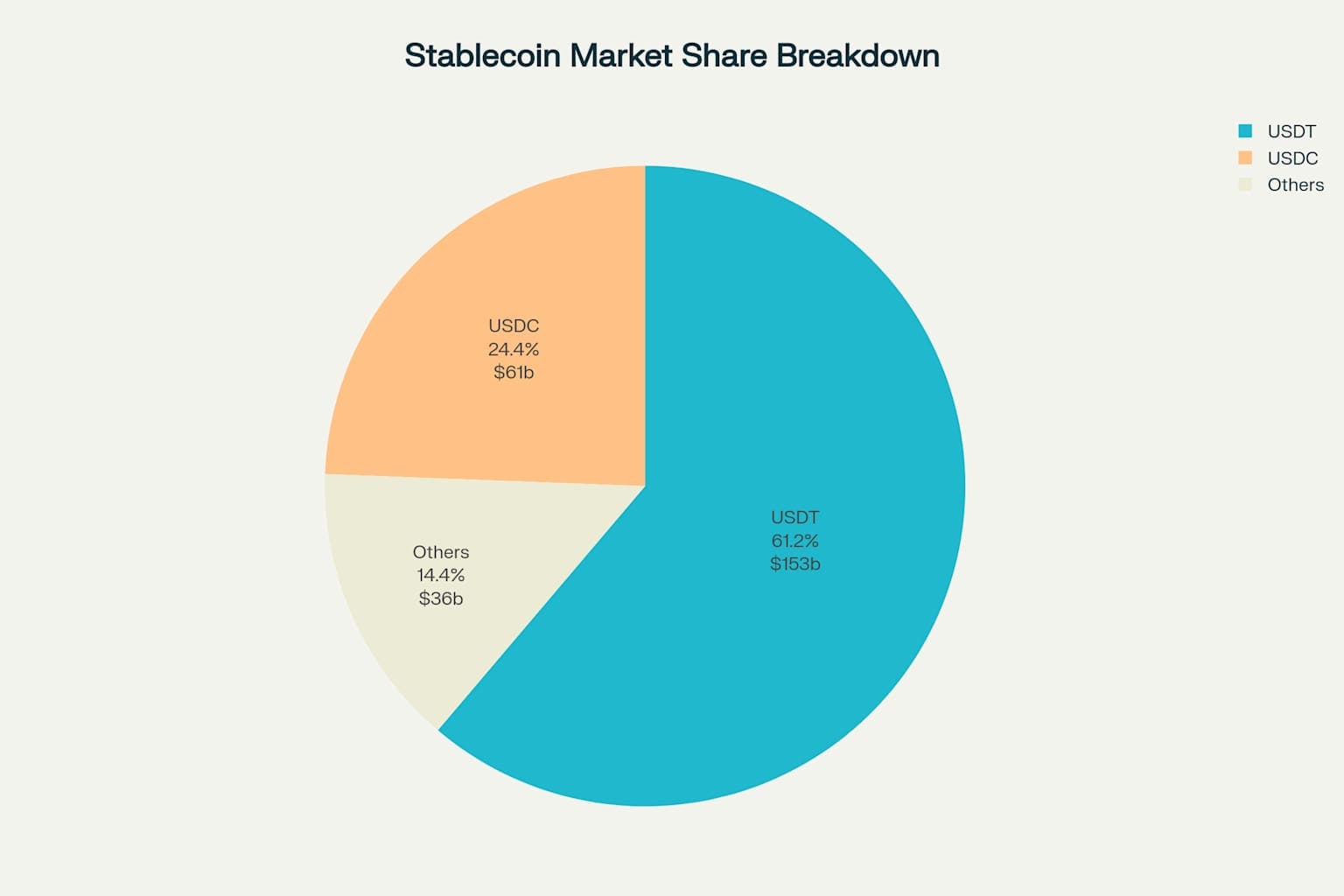

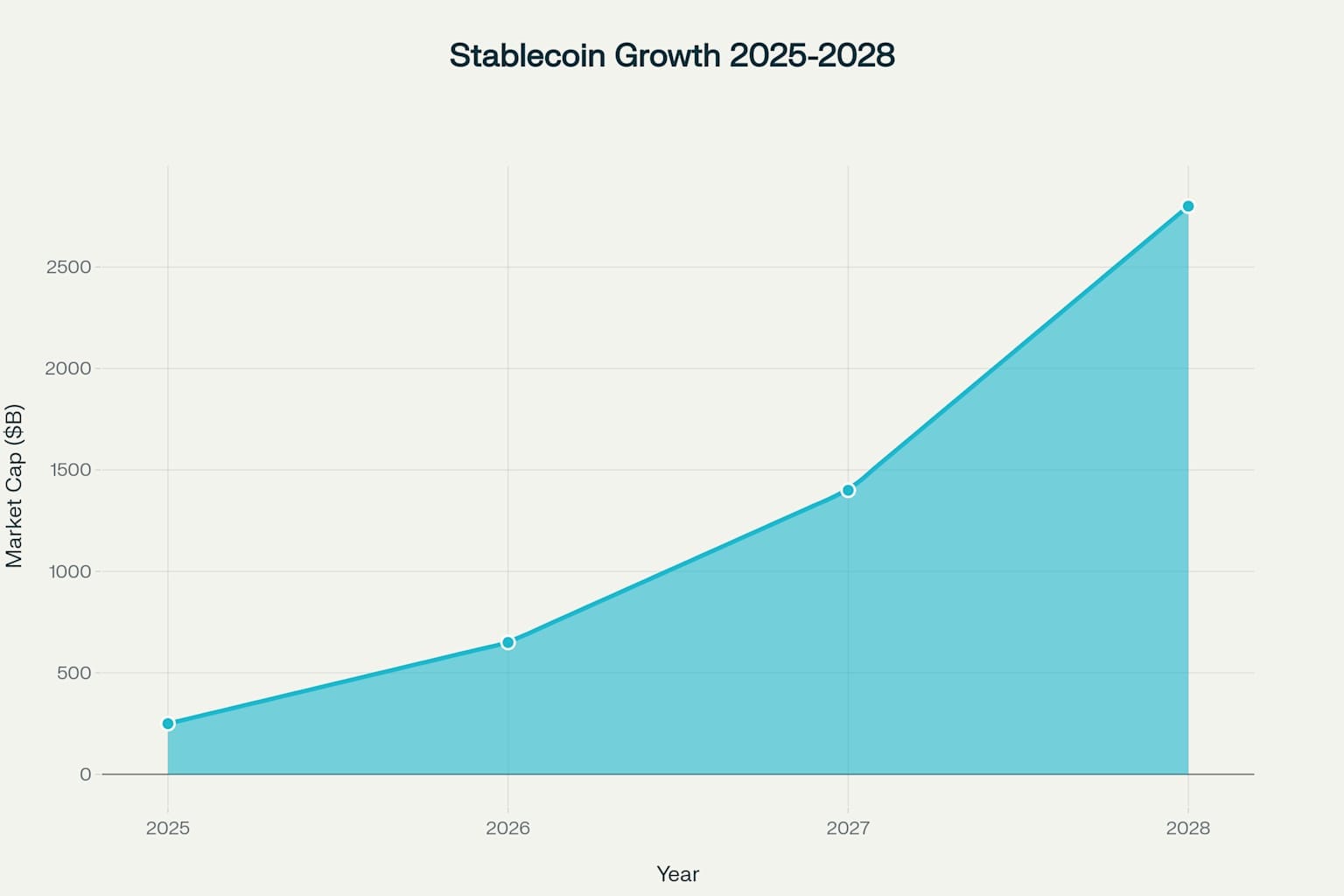

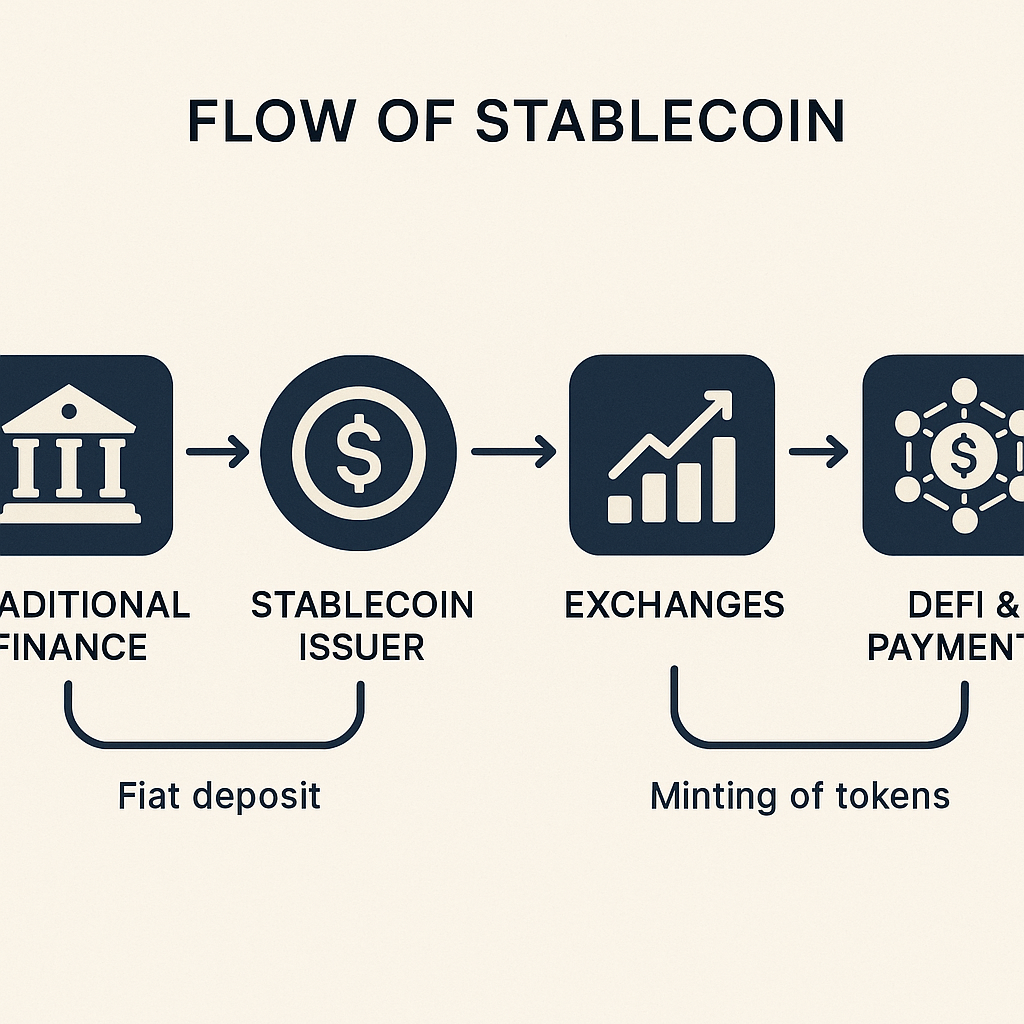

The stablecoin market has emerged as one of cryptocurrency's most critical use cases, fundamentally transforming global money movement. As of 2025, stablecoins have achieved a market capitalization exceeding $250 billion, with monthly transaction volumes reaching trillions of dollars. Tether (USDT) dominates this landscape with approximately $153 billion in circulation, representing nearly 61.2% of the total stablecoin market share.

The growth trajectory for stablecoins appears exponential, with Bernstein Research forecasting the market could expand to nearly $2.8 trillion by 2028. This represents a more than tenfold increase from current levels, driven by broader adoption across payments, remittances, and decentralized finance applications. The stablecoin ecosystem has already demonstrated its utility by processing $32.8 trillion in transfers during 2024 alone, surpassing traditional payment networks like Visa.

Stablecoin issuers have become extraordinarily profitable, with Tether emerging as one of the most profitable companies in the world per employee. This profitability stems from their ability to invest user deposits in short-term U.S. treasuries while retaining the full yield, currently around 4-5% annually . Tether and Circle, the two largest stablecoin issuers, collectively hold over $204 billion in U.S. Treasuries, making them the 14th largest holder globally, surpassing entire nations including Norway and Brazil.

Technical Architecture and Innovation

PlasmaBFT Consensus Mechanism

Plasma's technical foundation rests on PlasmaBFT, a custom consensus protocol inspired by Fast HotStuff that delivers rapid finality and low-latency transaction processing. The consensus mechanism operates under classic Byzantine Fault Tolerance (BFT) security assumptions, remaining secure when no more than 33% of validators are malicious. PlasmaBFT achieves high throughput by processing thousands of transactions per second while maintaining the efficiency of signature aggregation.

The protocol employs a two-chain commit mechanism that reduces communication steps compared to traditional BFT systems. In the happy path, when a newly proposed block builds directly on its predecessor, Quorum Certificates (QCs) alone establish correctness while benefiting from rapid finality. The system additionally utilizes pipelining to improve throughput, allowing newer proposals to continue in parallel while previous rounds complete their precommit and commit phases.

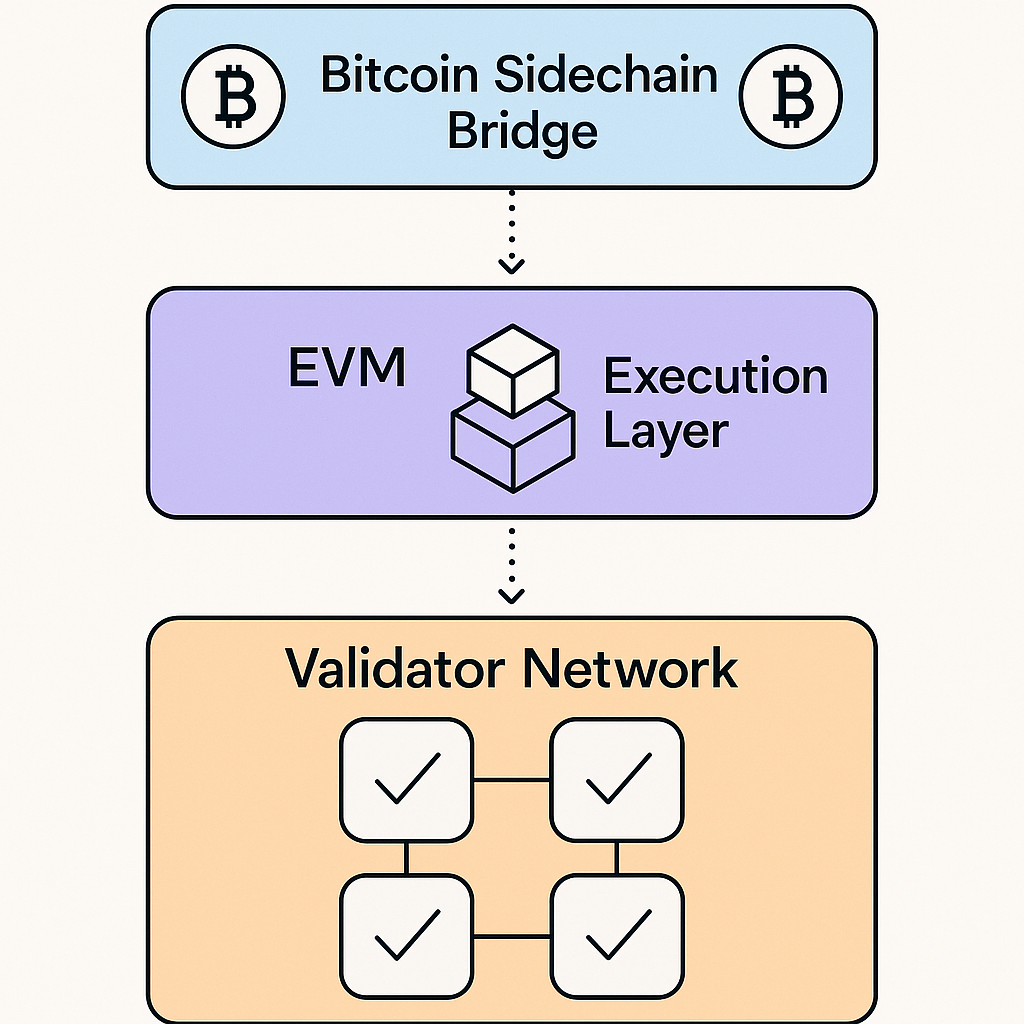

EVM Compatibility and Execution Layer

Plasma features a general-purpose Ethereum Virtual Machine (EVM) as its core execution environment, a critical choice given that over 90% of stablecoin infrastructure and applications are built on the EVM. The execution layer is constructed on Reth, a high-performance, modular, Ethereum-compatible execution engine written in Rust. This architecture enables any smart contract deployable on Ethereum to be deployed on Plasma without requiring code modifications.

The EVM compatibility ensures developers can seamlessly deploy existing smart contracts and leverage the extensive tooling available in the wider Ethereum ecosystem. Plasma introduces several performance and usability enhancements at the execution layer while remaining fully compliant with the EVM specification.

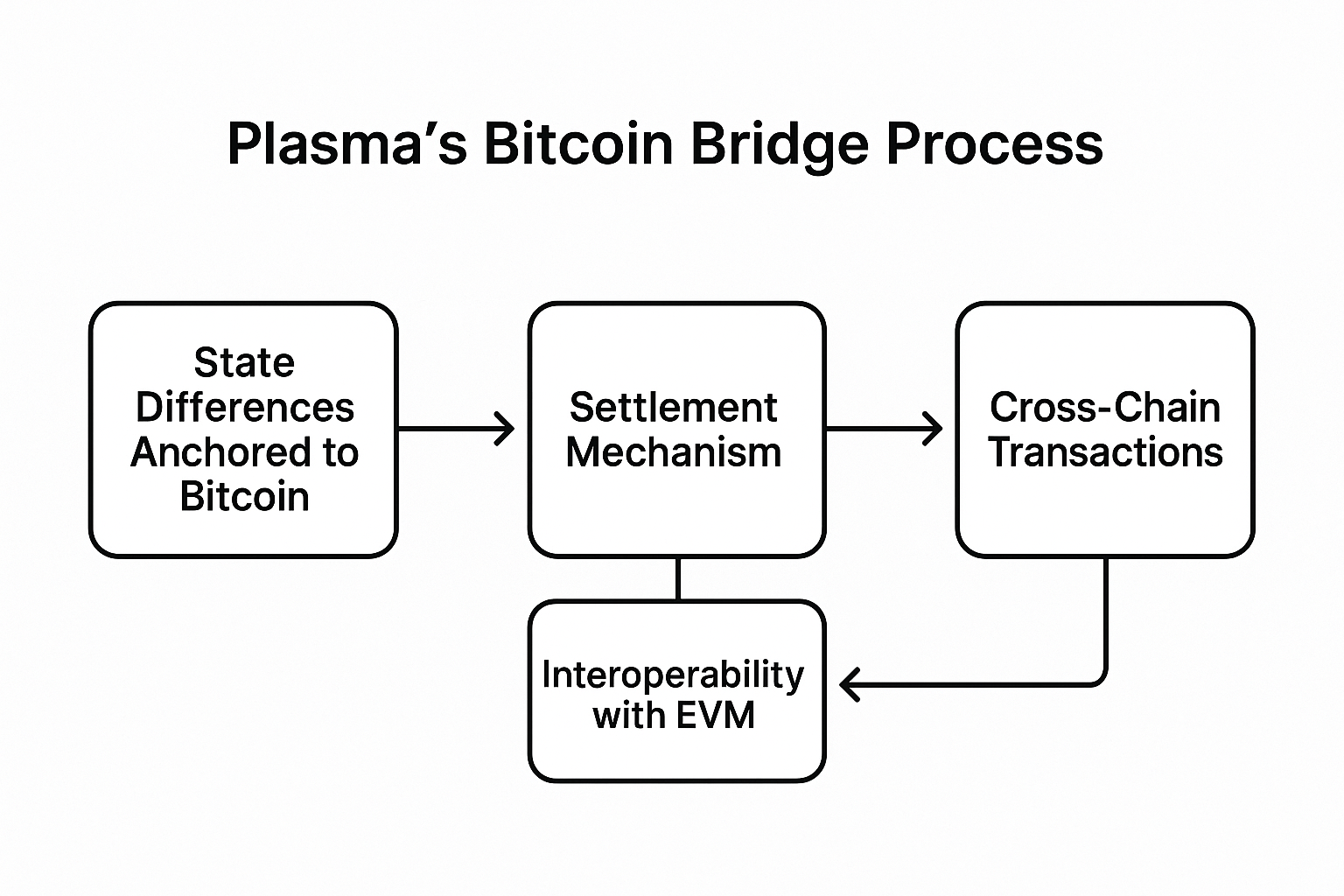

Bitcoin Sidechain Architecture

As a Bitcoin sidechain, Plasma anchors its state roots to Bitcoin, providing robust security guarantees without inheriting Bitcoin's scalability limitations. The platform features a trust-minimized Bitcoin bridge that periodically links state differences to the Bitcoin blockchain. This design delivers permissionless finality, stronger censorship resistance, and a universally verifiable source of truth.

The Bitcoin bridge uses the same group of decentralized validators as the BFT consensus mechanism, enabling seamless interoperability between Ethereum applications and Bitcoin's settlement layer. This architecture positions Plasma uniquely in the market by combining Ethereum's execution capabilities with Bitcoin's unmatched security properties.

Competitive Advantages and Market Positioning

Plasma's purpose-built design creates significant advantages over general-purpose blockchains for stablecoin transactions. Traditional blockchains face obstacles including high transaction fees, centralization issues, high failure rates, and lack of specialized features required for stablecoin operations.

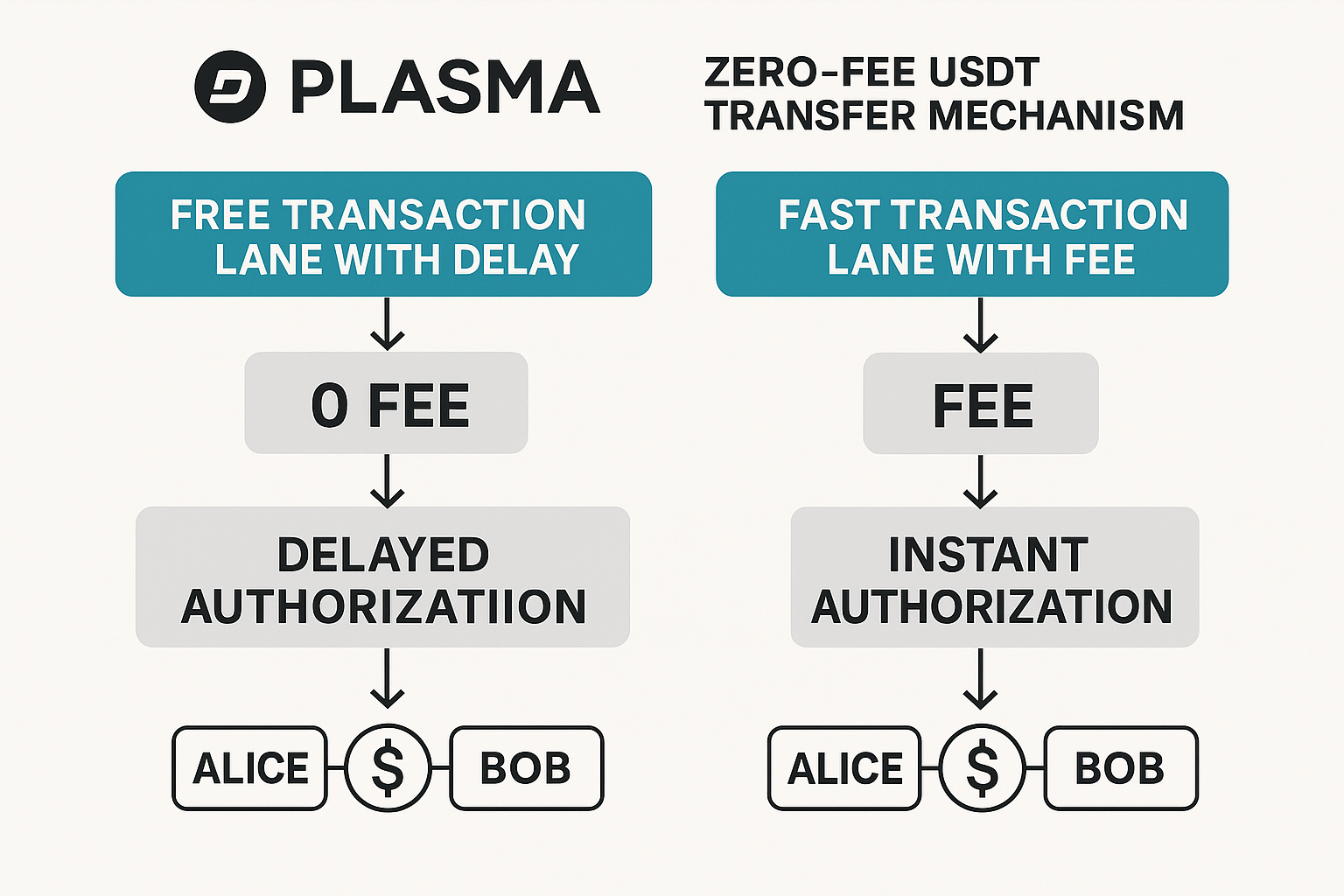

Zero-Fee USDT Transfers

One of Plasma's most significant innovations is enabling zero-fee USDT transfers through a delay-based prioritization system. Users can choose between immediate transfers with standard fees or fee-free transfers with longer processing times, optimizing for different use cases. This feature addresses one of the primary barriers to stablecoin adoption in everyday payments.

Custom Gas Tokens

Plasma introduces custom gas tokens that allow transaction fees to be paid in popular assets like USDT or BTC rather than requiring a native token.This functionality is implemented through an automated swap mechanism that enhances user experience by eliminating the need to hold multiple tokens for transaction processing.

Specialized Stablecoin Features

The platform includes confidential transactions to protect user privacy while maintaining compliance requirements. These features are currently under active research and development, positioning Plasma to address regulatory concerns while preserving user financial privacy .

Funding and Strategic Backing

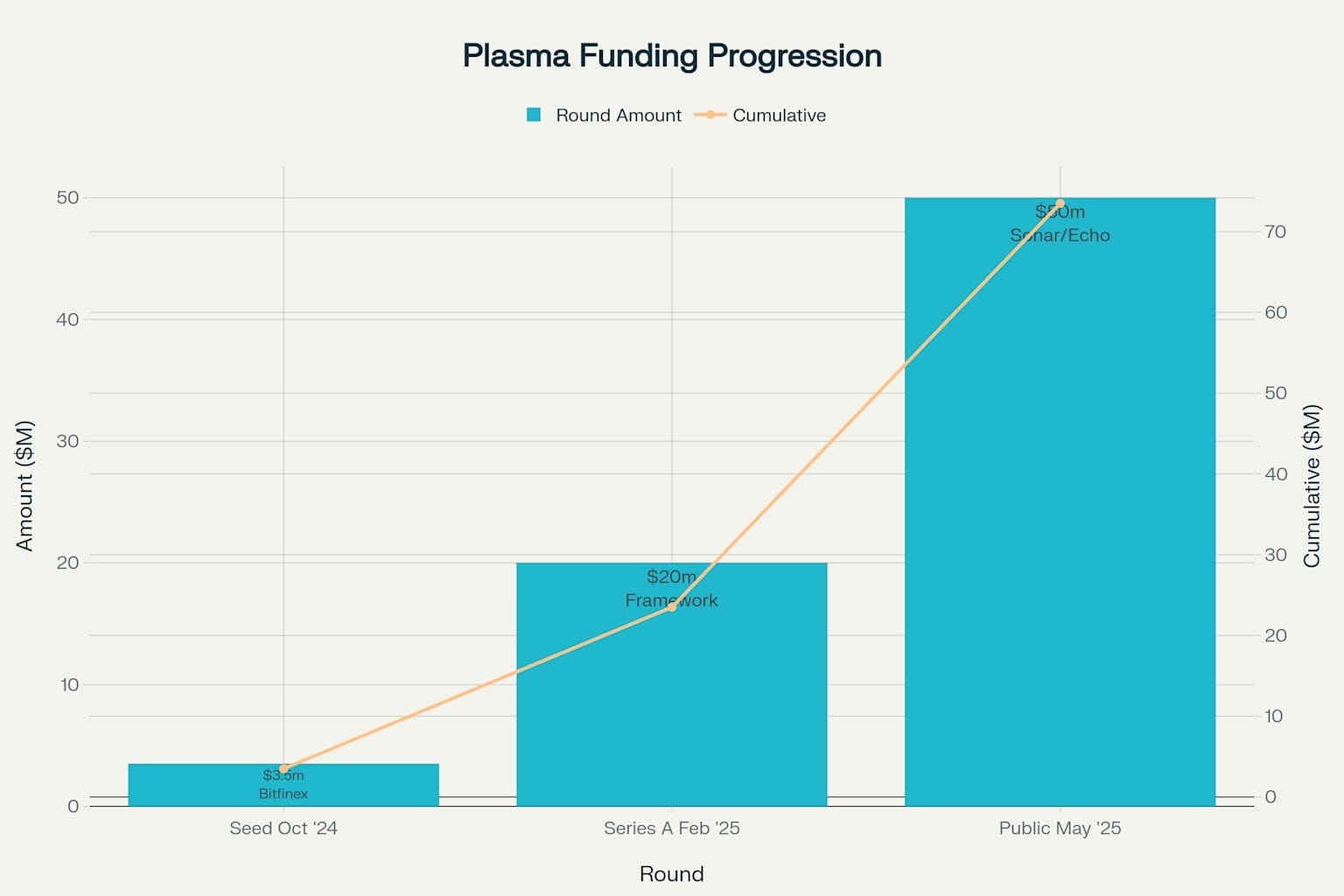

Plasma has secured substantial funding across multiple rounds, demonstrating strong institutional confidence in the project's vision. The company raised $3.5 million in its initial seed round led by Bitfinex in October 2024, followed by a $20 million Series A led by Framework Ventures in February 2025. Most recently, Plasma launched a $50 million public token sale through Cobie's new Sonar platform in May 2025.

The investor roster includes prominent figures from both traditional finance and cryptocurrency, including Peter Thiel, Paolo Ardoino (Tether CEO), DRW/Cumberland, Bybit, Flow Traders, and Nomura. This backing provides not only capital but also strategic partnerships essential for stablecoin infrastructure development.

XPL Token Sale and Valuation

The XPL token sale represents 10% of Plasma's total token supply, offering 1 billion tokens at $0.05 each, implying a $500 million fully diluted valuation. Participants deposit stablecoins (USDT, USDC, USDS, or DAI) into a Plasma Vault on Ethereum, with allocations determined by time-weighted share of total vault deposits. The sale structure rewards early and long-term participation while providing broad public access to the project.

Current Status and Development Roadmap

Plasma follows a phased rollout strategy prioritizing rapid deployment and integration with key stablecoin infrastructure. The project is currently in private testnet, with a public testnet expected soon and mainnet targeted for late summer 2025.

Phase 1: Mainnet Beta

The initial mainnet beta will deploy core components including the PlasmaBFT consensus protocol and fully EVM-compatible execution layer.This phase establishes a stable foundation for early integration with stablecoin issuers, onramp providers, liquidity providers, and banking-as-a-service platforms.

Phase 2: Bitcoin Bridge Implementation

Following the mainnet beta, Plasma will implement its native, trust-minimized Bitcoin Bridge and settlement mechanism. This phase will deploy infrastructure that anchors Plasma state differences to Bitcoin, ensuring seamless access to Bitcoin liquidity and robust interoperability.

Phase 3: Core Feature Enhancements

The focus will shift to shipping Plasma's specialized stablecoin features, including custom gas tokens, zero-fee USDT transfers, and confidential transactions. This phase addresses the technical challenges of stablecoin payments while optimizing performance, usability, and network efficiency.

Strategic Partnerships and Ecosystem Development

Plasma is actively building partnerships across the stablecoin and DeFi ecosystem. The project has secured integrations with key DeFi protocols including Ethena, Aave, Morpho, Curve, and Maker. These partnerships provide essential liquidity and functionality for the Plasma ecosystem.

The team is also developing regional infrastructure and institutional partnerships focused on payments and remittances. With backing from Bitfinex and USD₮0, Plasma has direct access to the largest stablecoin issuer in the world, providing a significant competitive advantage.

Market Impact and Future Implications

Plasma's emergence reflects the broader maturation of the stablecoin market and recognition that specialized infrastructure is required to unlock the full potential of digital dollars. The project addresses critical pain points in current stablecoin infrastructure while positioning itself to capture significant market share as adoption accelerates.

The convergence of regulatory clarity, institutional adoption, and technological advancement creates favorable conditions for Plasma's success. Recent policy developments, including President Trump's executive order promoting dollar-backed stablecoins and Senator Hagerty's stablecoin bill, signal growing governmental support for the sector.

Conclusion

Plasma represents a significant evolution in blockchain infrastructure, specifically designed to address the unique requirements of the stablecoin economy. By combining Bitcoin's security with Ethereum's functionality and adding specialized features for stablecoin transactions, Plasma creates a compelling platform for the next generation of digital finance. The substantial funding, strategic partnerships, and technical innovations position Plasma to play a central role in the trillion-dollar stablecoin opportunity that lies ahead.