Nansen.ai: Cutting-Edge Blockchain Analytics Platform

Nansen.ai stands as a leading blockchain analytics platform that empowers crypto investors and teams with actionable on-chain insights across multiple blockchains. Founded in 2019, this Singapore-based company has rapidly established itself as an essential intelligence tool for serious crypto investors seeking to identify opportunities, perform due diligence, and protect their portfolios through real-time dashboards and alerts.

The Evolution of Blockchain Analytics

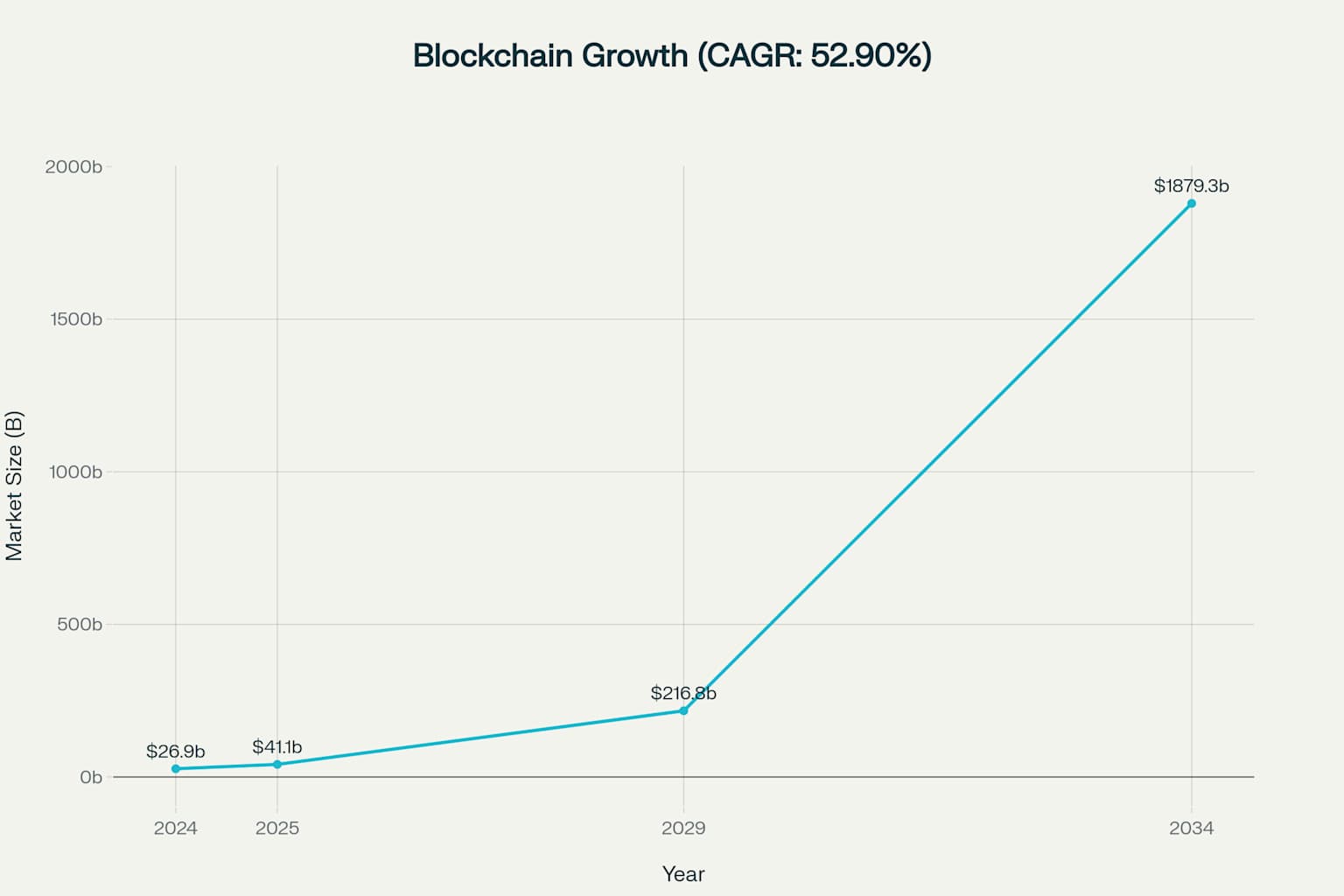

The blockchain analytics market is experiencing explosive growth, projected to expand from $41.15 billion in 2025 to approximately $1,879.30 billion by 2034, representing a compound annual growth rate (CAGR) of 52.90%. This surge highlights the increasing importance of on-chain data analysis tools like Nansen in the rapidly evolving crypto landscape.

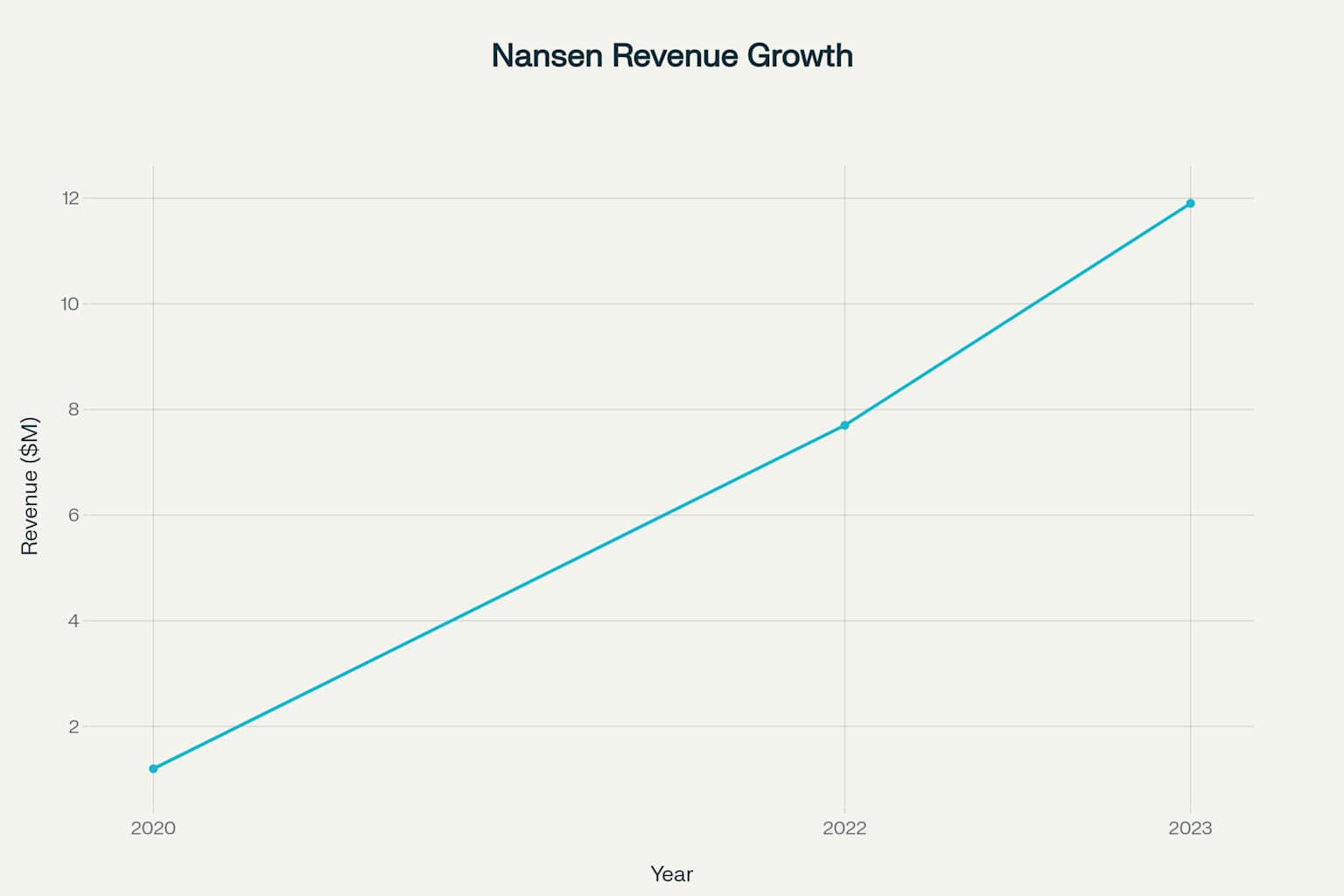

Since its inception, Nansen has demonstrated impressive financial performance, with revenue growing from $1.2 million in 2020 to $11.9 million in 2023, reflecting a 54.92% year-over-year increase that underscores the platform's market traction and expanding user base.

Core Capabilities and Technology

Nansen's competitive edge stems from its massive database of labeled wallet addresses—currently over 300 million across 20+ blockchains—which enables users to "decode" blockchain activity and identify patterns that would otherwise remain hidden. This proprietary labeling system categorizes wallet addresses based on their behaviors, holdings, and interactions, providing crucial context that transforms raw on-chain data into actionable intelligence.

The platform's technology stack has evolved significantly with the launch of Nansen 2, featuring:

- Enhanced Speed and Performance: The completely rebuilt infrastructure delivers loading times that are up to 100x faster than the previous version.

- AI Integration: Advanced machine learning algorithms and GPT-like techniques analyze massive datasets to identify anomalies and surface significant trends.

- Real-Time Data Processing: Immediate insights into on-chain activities as they occur, enabling users to capitalize on emerging opportunities.

Product Portfolio and User Segments

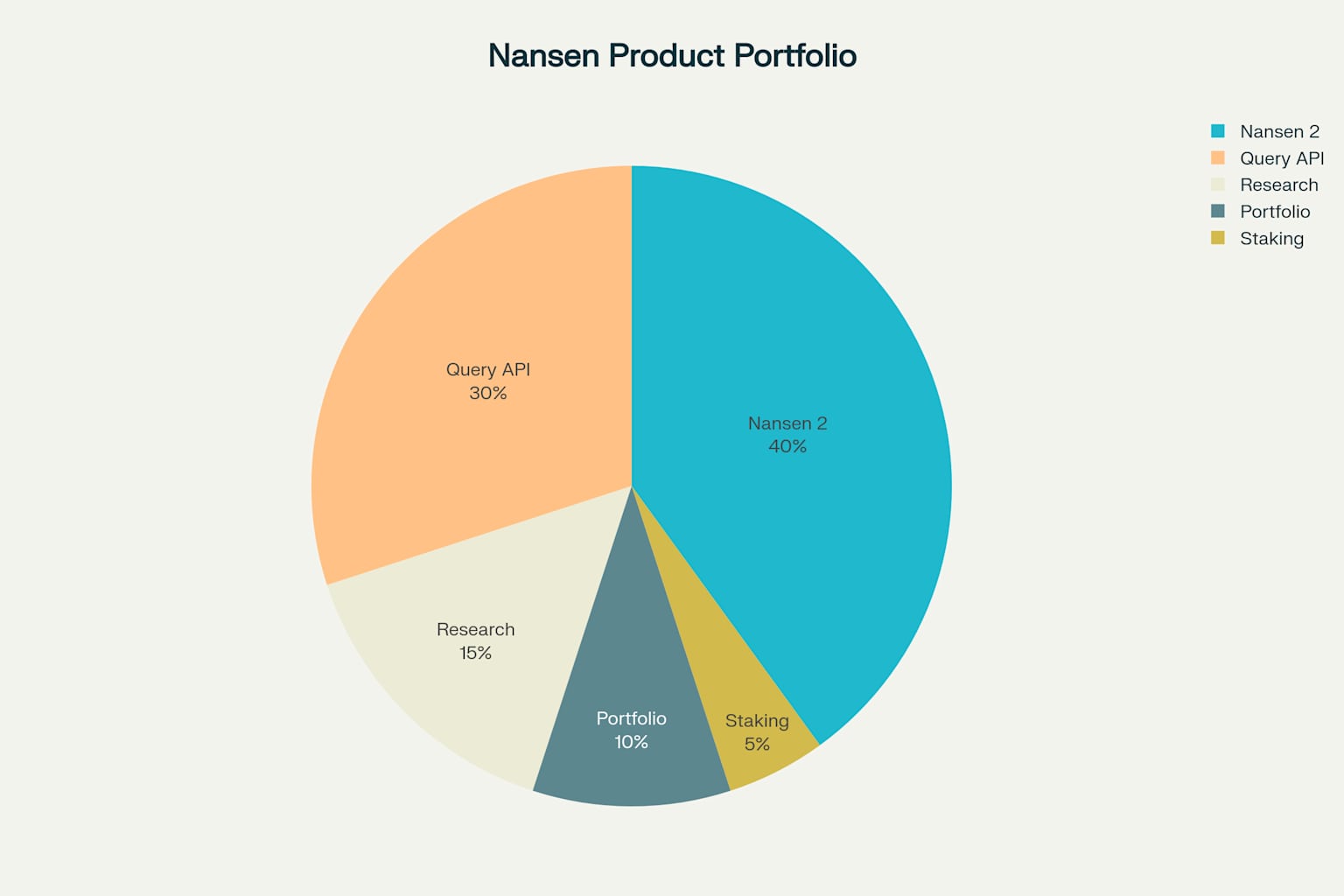

Nansen offers a comprehensive suite of products designed for different user segments, with each component addressing specific needs within the crypto analytics ecosystem.

Nansen 2 - Core Analytics Platform

The flagship product, Nansen 2, targets individual traders and investors with features like Smart Money tracking, hot contracts identification, and token analysis. This platform enables users to follow wallet behaviors of successful traders, identify trending projects, and monitor significant token movements across multiple blockchains.

Nansen Query - Enterprise Solution

For institutional clients and developers, Nansen Query provides programmatic access to blockchain data via SQL queries, enabling custom analytics dashboards and integration with existing data pipelines. This enterprise-grade solution offers enhanced data context through Nansen's unique labeling system, making it up to 60 times faster than competing solutions.

Research Portal - Professional Insights

The Nansen Research Portal delivers professional-grade research reports created by specialist analysts, covering crypto ecosystems, projects, infrastructure, and industry trends across NFTs, gaming, DeFi, stablecoins, and DAOs. This content was previously exclusive to Alpha tier customers but has now been made available to Standard and VIP tier subscribers as well.

Portfolio Tracker and Staking Hub

Complementing the analytics tools, Nansen offers a Portfolio Tracker that provides aggregated insights across 40+ chains and a Staking Hub that enables users to stake assets across 20+ networks. These products are being integrated into the Nansen 2 platform to create a more unified experience.

Smart Money Tracking: Nansen's Signature Feature

At the heart of Nansen's value proposition is its Smart Money tracking capability, which identifies and monitors wallets belonging to highly successful traders and institutional investors. This feature enables users to:

- Follow Top Performers: Track the activities of wallets in the top percentile of profitability across various sectors.

- Detect Early Trends: Spot emerging opportunities by monitoring what the most successful investors are buying or accumulating.

- Set Custom Alerts: Receive notifications when Smart Money wallets make significant moves, allowing for timely responses to market developments.

Smart Money in Nansen's context refers to two primary categories: institutional funds and influential whales with market expertise, and top-performing on-chain participants who consistently generate profits across various activities. The platform's Smart Money dashboard has been redesigned to offer multi-chain support across 10 networks, including Solana, with features like a Profit & Loss leaderboard and real-time DEX trades monitoring.

Wallet Labeling: The Data Foundation

Nansen's wallet labeling system forms the backbone of its analytics capabilities, with over 300 million labeled addresses across numerous blockchains. This proprietary technology employs various methods to assign labels, including:

- Heuristics and Algorithms: Automated systems that infer wallet types based on transaction patterns and interactions.

- Smart Contract Analysis: Parsing contract interactions to determine wallet behaviors and purposes.

- Network Effect Labeling: Using known wallet labels to infer the types of connected wallets, creating a compounding effect that enhances the system's accuracy over time.

The platform maintains an emphasis on precision, preferring not to label an address rather than assign an incorrect label, with more than 99% of labels being algorithmically inferred. Users can also create custom labels for wallets of interest, enhancing the platform's utility for personal research and analysis.

Multi-Chain Analytics Coverage

Nansen has aggressively expanded its blockchain coverage, now supporting analytics across more than 20 networks. The core analytics product (Nansen 2) currently supports over 12 chains, while Nansen Query covers 20+ networks, and the Portfolio Tracker extends to more than 50 chains.

Key supported blockchains include:

- Ethereum and Layer-2s: Complete coverage of Ethereum, Arbitrum, Polygon, Base, and Optimism.

- Alternative Layer-1s: Support for Solana, BNB Chain, Avalanche, Fantom, and newer networks like TON.

- Emerging Ecosystems: Recent integrations with IOTA EVM, HyperEVM, and other innovative blockchain platforms.

This multi-chain approach allows users to track assets, monitor Smart Money movements, and analyze market trends across the fragmented blockchain landscape, providing a comprehensive view that single-chain analytics platforms cannot match.

Market Position and Competition

In the blockchain analytics space, Nansen competes with several other platforms, each with distinct strengths and focus areas. While Nansen excels in wallet labeling and Smart Money tracking for investors, alternatives like Dune Analytics focus on SQL-based community analytics, Chainalysis targets compliance and investigation for enterprises, and Glassnode specializes in market intelligence and on-chain metrics.

Specific differentiators that separate Nansen from competitors include:

- Labeled Addresses: Nansen's 300+ million labeled addresses far exceed the competition, providing contextual depth that other platforms lack.

- Real-Time Alerts: Customizable notifications for whale movements, wallet changes, and token trends delivered via various channels.

- AI Integration: Advanced artificial intelligence that personalizes insights based on user portfolios and interests.

With pricing ranging from $99/month to $1,299/month for premium tiers, Nansen positions itself as a professional tool for serious investors, though this places it at a higher price point than some competitors offering freemium models.You can get 10% OFF using this link https://nsn.ai/gamefi

Business Growth and Funding

Nansen has secured significant venture capital backing, with a $75 million Series B funding round in December 2021 led by Accel, with participation from GIC, Andreessen Horowitz (a16z), Tiger Global, SCB 10X, and other prominent investors. This round followed a Series A earlier in 2021, bringing the total funding to approximately $88 million.

The company has used this capital to fuel rapid expansion, with revenue growing from $1.2 million in 2020 to $11.9 million in 2023. This growth trajectory reflects increasing demand for Nansen's services across both retail and institutional segments of the crypto market.

Future Outlook and Strategic Direction

Looking ahead, Nansen is focused on several strategic initiatives that will shape its evolution:

- AI-Driven Analytics: Deeper integration of artificial intelligence throughout the platform, with features like Signals that identify unusual on-chain activities and personalized insights.

- Expanded Chain Support: Continuing to add approximately one new blockchain per month to increase coverage across the multi-chain landscape.

- Enhanced Enterprise Offerings: Further development of Nansen Query and API solutions to serve institutional clients and developers with programmatic data access.

- Unified Platform Experience: Integration of all products into a cohesive ecosystem, with Portfolio features being incorporated into Nansen.

According to CEO Alex Svanevik, 2025 is poised to deliver "the mother of all bull markets" in crypto, with catalysts including regulatory clarity and technological advances that will drive increased demand for analytics tools like Nansen.

Conclusion

Nansen.ai has established itself as an indispensable tool for crypto investors seeking an edge in a complex, data-rich environment. Through its innovative wallet labeling technology, Smart Money tracking capabilities, and multi-chain support, the platform transforms blockchain transparency from a theoretical benefit into practical, actionable intelligence.

As the blockchain analytics market continues its explosive growth trajectory, Nansen's combination of technological innovation, strategic partnerships, and clear product-market fit positions it well to maintain its leadership position in this rapidly evolving space. For investors and teams seeking to navigate the complex world of crypto with confidence, Nansen represents a powerful ally in transforming raw blockchain data into valuable investment intelligence.